45+ Write Letter To Irs

They have a balance due. Free Case Review Begin Online.

4 Ways To Write A Letter To The Irs Wikihow

Web Sample letter to IRS requesting them to waive a penalty.

. They are due a. Web Instructions Instructions for Form 2848 092021 Power of Attorney and Declaration of Representative Section references are to the Internal Revenue Code unless otherwise. Web The IRS will ask you for a letter and proof of your inability to pay and will continue charging fees and interest during this period.

Each notice deals with a specific issue and includes any steps. Web If your notice or letter requires a response by a specific date there are many reasons youll want to comply. Web CorrectAmend a Return Identity Theft Fraud and Scams Business Topics Telephone and Local Assistance If you mailed a tax return or letter and havent yet.

Web The Many Forms of an IRS Letter IRS Notice of Deficiency. So what should you include in this hardship letter to. Web IRS Tax Tip 2021-52 April 19 2021 The IRS mails letters or notices to taxpayers for a variety of reasons including if.

Web When the IRS needs to ask a question about a taxpayers tax return notify them about a change to their account or request a payment the agency often mails a. Web You can also write to us at the address in the notice or letter. Web Understanding Your CP45 Notice What this notice is about We were unable to apply your overpayment to your estimated tax as you requested.

Web The Internal Revenue Service IRS will send a notice or a letter for any number of reasons. It is the amount by which the imposed tax exceeds that which. It may be about a specific issue on your federal tax return or.

Agree with the changes the IRS is making or send a written explanation of why the IRS is wrong and you are right. If you write allow at least 30 days for our response. The location of the notice or letter number.

CP3219A Notice Tax Deficiency Definition. Minimize additional interest and. Web These letters give you 30 or 45 days from the date of the letter to provide the requested information or request a conference with the IRS Independent Office of.

Web Read the letter carefully. You will see your IRS notice number in the upper right corner of the letter. The IRS does not accept tax.

Ad See If You Qualify For IRS Fresh Start Program. Most IRS letters and notices are about federal tax returns or tax accounts. Web Create a subject line with Re followed by your IRS notice number.

I am confident that I have the skills and qualifications that you are. As a last resort you can use the IRS toll-free number 1-800-829-1040. We Help Taxpayers Get Relief From IRS Back Taxes.

Here are just a few. What you need to do. Web Most IRS letters have two options.

Definitely no taxpayer would like to have tax penalties leveled against them not even in cases when it. Web Dear name I am writing to apply for the open IRS Agent position that I saw on your website. Web The telephone number is usually found in the upper right-hand corner of your notice or letter.

Web Find your local IRS office - Locate a Taxpayer Assistance Center office near you and make an appointment to get help in person. Web If you think youll have trouble paying your taxes or the NFTL filing will cause economic hardship its helpful to know what your options are to address your tax debt.

Cra Letter Of Intention To Revoke Charitable Status Of The Canadian Islamic Trust Foundation Pdf Charitable Organization Government

Rian Watt Rianwatt X

Irs Letter 4464c Sample 2

Cyqljrvx U 3tm

I Got A Notice From The Irs Taxpayer Advocate Service

4 Ways To Write A Letter To The Irs Wikihow

Donation Requests 45 Awesome Companies Giving Millions

What To Write On A Baby Shower Card

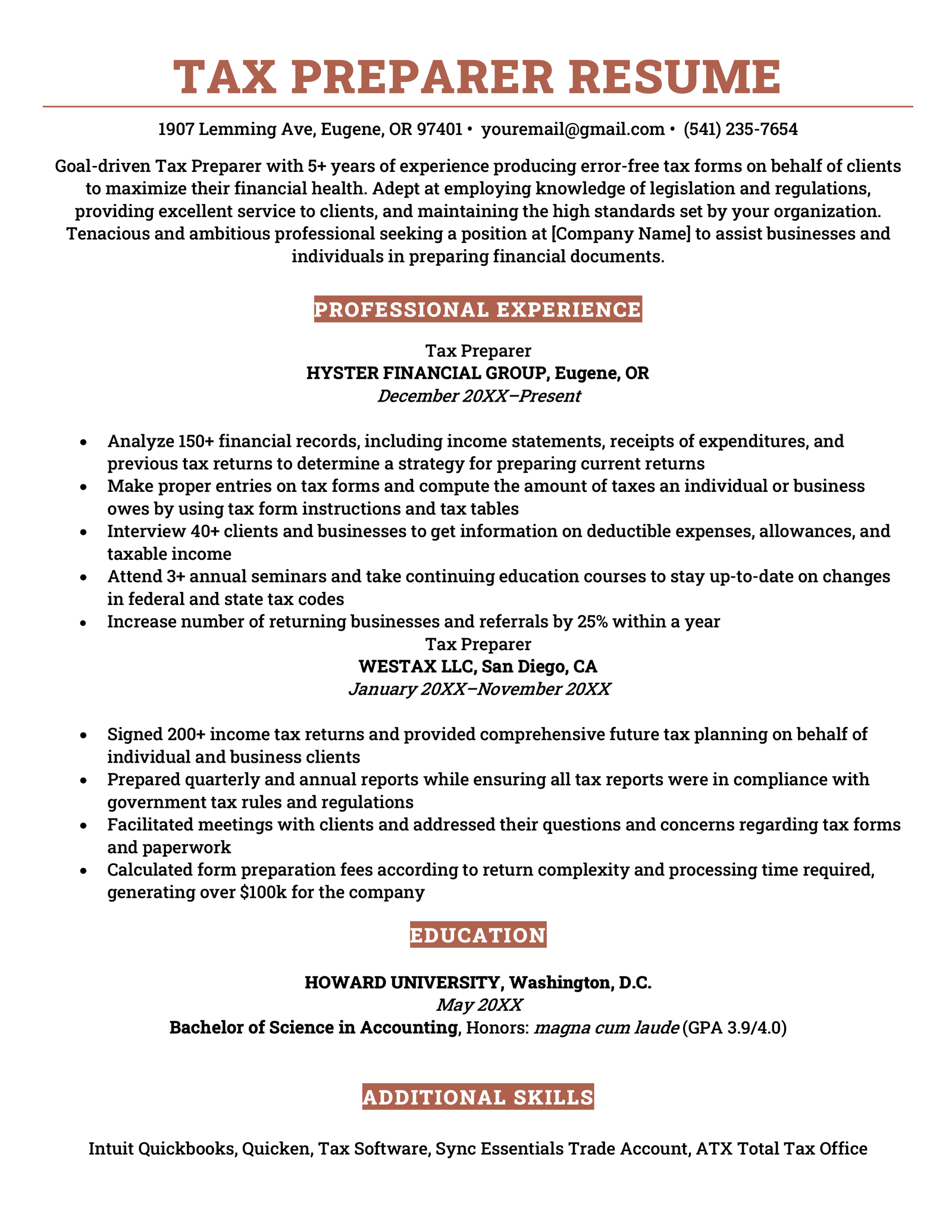

Tax Preparer Resume Sample How To Write

Irs Letter 4464c Sample 2

4 Ways To Write A Letter To The Irs Wikihow

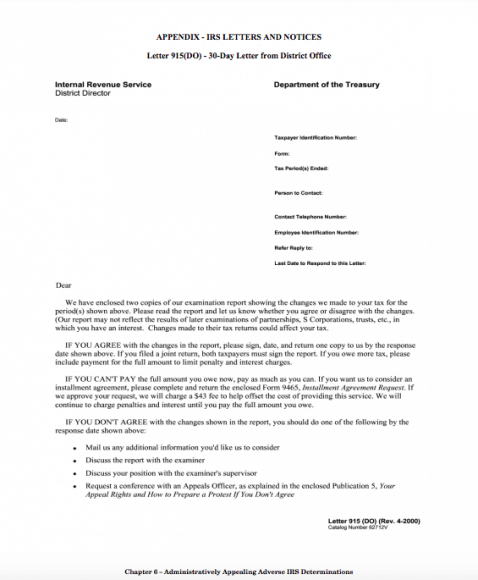

Irs Letter 915 What It Means And How To Respond To It Supermoney

Writing Letter To Irs Can Be Easier If You Know Who To Contact

Irs Letter If We Don T Hear From You We May Have To Increase The Tax You Owe Or Reduce Your Refund The Isaac Brock Society

Writing Letter To Irs Can Be Easier If You Know Who To Contact

The Proper Way To Address A Letter To The Irs Sapling

Tax Smarts My Best Advice From 45 Years As A Tax Professional Kindle Edition By Flach Robert Professional Technical Kindle Ebooks Amazon Com